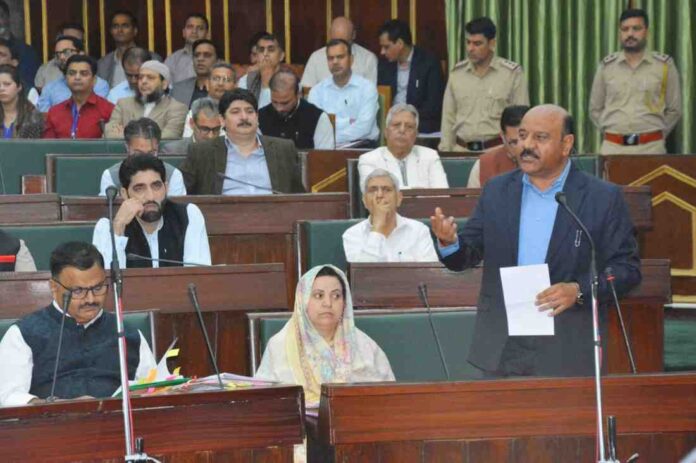

MARCH 23:In a significant move, Deputy Chief Minister of Jammu and Kashmir, Surinder Choudhary, today tabled the Bill to amend the Jammu and Kashmir Goods and Services Tax Act, 2017 (L.A. Bill No. 1 of 2025) in the Legislative Assembly. The introduction of the Bill marks a key step towards bringing about necessary changes to the current framework of GST in the Union Territory.

The Bill, which has already been published in an extraordinary issue of the Official Gazette, aims to make amendments to the existing Goods and Services Tax Act, which was first introduced in the region in 2017. The amendments are expected to streamline GST-related procedures and ensure better compliance, along with addressing several technical and operational issues that have surfaced since the enactment of the original legislation. These changes are in line with the ongoing efforts of the Jammu and Kashmir government to improve its fiscal policies and economic growth.

The introduction of the Bill comes as part of the Jammu and Kashmir government’s broader strategy to align with the latest developments in the taxation system, ensuring it reflects the evolving needs of both businesses and consumers in the region. Deputy Chief Minister Choudhary, while tabling the Bill, emphasized the importance of modernizing the GST framework to match the dynamic business environment, which will ultimately facilitate easier taxation procedures and foster economic growth in the Union Territory.

The Bill was introduced on behalf of Chief Minister Omar Abdullah, who was unable to attend the session. Choudhary highlighted that the amendments have been carefully drafted after extensive consultations with stakeholders and experts in the field of taxation. These discussions have aimed at addressing any challenges faced by businesses, particularly small and medium enterprises, and ensuring that the revised GST system is both effective and practical.

The amendments will likely bring about significant improvements in areas such as tax administration, compliance, and enforcement, with a focus on simplifying procedures for businesses while enhancing transparency and accountability. Additionally, the government aims to make the tax system more efficient, thereby contributing to the overall economic growth of Jammu and Kashmir.

With the introduction of this Bill, the Jammu and Kashmir government is taking proactive steps to ensure that the region’s fiscal policies remain robust and responsive to the changing economic landscape.