June 5:

Sahil Aggarwal (Editor-in-Chief)

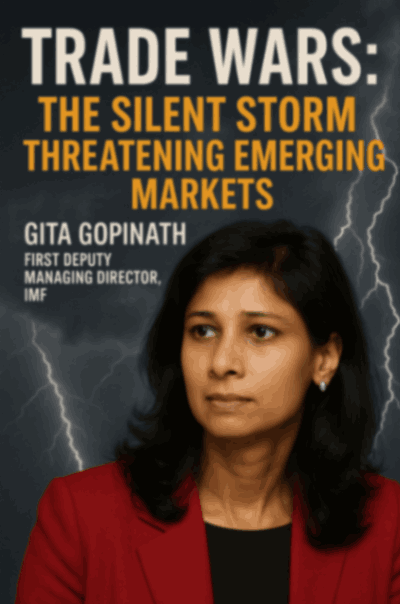

As the dust settles on the global COVID-19 pandemic, a more insidious storm is gathering on the horizon — trade wars. At the heart of this economic turbulence stands Gita Gopinath, the First Deputy Managing Director of the International Monetary Fund (IMF), who recently warned that for emerging market central banks, the ripple effects of escalating trade tensions may prove to be more disruptive than even the pandemic.

It’s a bold claim, but one rooted in economic realities. During COVID-19, despite the global panic, central banks had a clear mandate: support demand and ensure liquidity. The playbook was simple — lower interest rates, inject capital, and stabilize financial systems. But trade wars are an entirely different beast.

Unlike a virus, trade wars are man-made, unpredictable, and politically charged. They do not spread uniformly, nor do they present a unified threat. Instead, they inject uncertainty into markets, disrupt global supply chains, and force policymakers in emerging economies to fight battles on multiple fronts — from inflation and currency depreciation to investor flight and fiscal imbalances.

Gopinath’s message is clear: the world is shifting from a model of multilateral cooperation to one defined by strategic rivalry. The U.S.-China trade standoff, rising protectionism in Europe, and sanctions-related politics are creating an economic climate in which emerging markets often find themselves caught in the crossfire, with little control over the narrative.

The impact is far-reaching. Countries heavily reliant on exports — be it manufacturing hubs like Vietnam and Bangladesh or commodity exporters like Brazil and South Africa — face sharp slowdowns when global demand becomes hostage to diplomatic disputes. Central banks, tasked with stabilizing their economies, often find themselves with fewer tools and more conflicting objectives.

Unlike the coordinated monetary easing of 2020, today’s emerging economies must walk a tightrope between curbing inflation and stimulating growth, all while navigating volatile foreign exchange markets and geopolitical headwinds. Trade wars introduce long-term uncertainty into investment and production decisions, leading to lower productivity and weaker growth outlooks.

So what can be done? According to Gopinath, international cooperation remains key. Rather than walling themselves off, countries need to build resilience through diversification — both in their trading partners and their economic structures. Investing in local innovation, strengthening regional alliances, and creating robust safety nets can cushion the blow from global shocks.

For emerging markets, this is a wake-up call. COVID-19 was a test of survival — trade wars may well be the test of endurance. The game has changed, and the new rules are still being written.