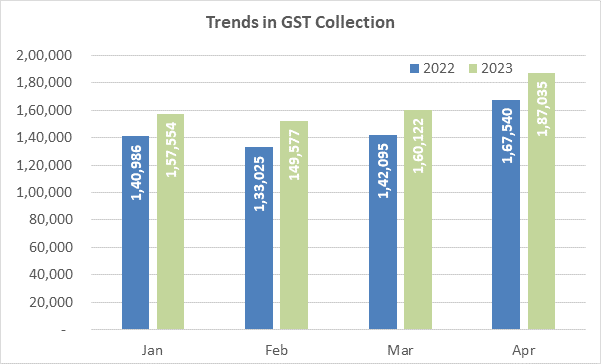

01 MAY 2023 , Delhi: The gross GST revenue collected in the month of April, 2023 is ₹ 1,87,035 crore of which CGST is ₹38,440 crore, SGST is ₹47,412 crore, IGST is ₹89,158 crore (including ₹34,972 crore collected on import of goods) and cess is ₹12,025 crore (including ₹901 crore collected on import of goods).

The government has settled ₹45,864 crore to CGST and ₹37,959 crore to SGST from IGST. The total revenue of Centre and the States in the month of April 2023 after regular settlement is ₹84,304 crore for CGST and ₹85,371 crore for the SGST.

The revenues for the month of April 2023 are 12% higher than the GST revenues in the same month last year. During the month, the revenues from domestic transactions (including import of services) are 16% higher than the revenues from these sources during the same month last year.

For the first time gross GST collection has crossed ₹1.75 lakh crore mark. Total number of e-way bills generated in the month of March 2023 was 9.0 crore, which is 11% higher than 8.1 crore e-way bills generated in the month of February 2023.

Month of April 2023 saw the highest ever tax collection on a single day on 20th April 2023. On 20th April 2023, ₹ 68,228 crore was paid through 9. 8 lakh transactions. The highest single day payment last year (on the same date) was

₹ 57,846 crore through 9.6 lakh transactions.

The chart below shows trends in monthly gross GST revenues during the current year. The table shows the state-wise figures of GST collected in each State during the month of April 2023 as compared to April 2022.